|

NOVEMBER 22, 2022 By Rajat Dosi, Partner, RSA Legal Solutions

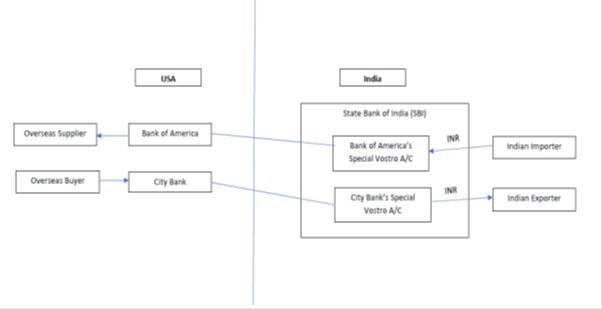

2. The RBI, vide its A.P. (DIR Series) Circular No.10 dated 11.07.2022, has introduced a new mechanism for settlement of international trade (import and export) in INR. This new mechanism permits invoicing, payment and settlement of Indian import and export transactions in INR. For enabling such settlement, the RBI has permitted authorized Indian Banks (AD category banks) to open and operate Special Rupee Vostro Accounts of banks of other countries in India. In simple words, this new mechanism permits international trade transactions in INR in the following ways:

3. Prior to the above new mechanism, export invoices could be denominated in free foreign exchange or in INR, however, payment and settlement was required to be done in free foreign exchange only, as per the FEMA laws (except for special arrangements such as the one made for transactions with Iran, which were permitted in INR). 4. The above new mechanism for settlement of international transactions in INR was also incorporated in the FTP in Para 2.52(d) vide the DGFT Notification No. 33/2015-2020 dated 16.09.2022. Even though the exporters were permitted to settle transactions in INR, via this new mechanism, however, such export transactions settled in INR were not eligible to avail certain export benefits provided under the FTP. Para 4.21 of the FTP (which pertains to the advance authorization scheme) and Para 5.11 of the HBP (which pertains to the EPCG scheme) allowed exports to be counted towards fulfilment of export obligation arising thereunder, only if the export proceeds are realized in free foreign exchange. 5. Given the above, now the following changes have been made in the FTP (vide the DGFT Notification No. 43/2015-20 dated 09.11.2022) and HBP (vide the DGFT Public Notice No. 35/2015-20 dated 09.11.2022) to extend the export benefits under the FTP to even such exports (settled in INR):

6. In simple words, vide the above amendments, the benefit of the advance authorization scheme, EPCG scheme and Status Holder Scheme, has been extended to even such exports realized in INR, in terms of above RBI circular dated 11.07.2022. 7. However, interestingly, no such corresponding changes have been made in the Export Oriented Unit (EOU) scheme in the FTP. Such exports realized in INR, in terms of above RBI circular dated 11.07.2022, have not been considered towards fulfilment of positive NFE requirement of the EOU scheme. Either the same has been missed out or may be in days to come a similar addition will be made even in the EOU Scheme to this effect. [The views expressed are strictly personal.]

|

1. THIS article seeks to briefly capture the new mechanism put in place by the Reserve Bank of India (“RBI“) which allows Indian import and export transactions to be settled in Indian Rupees (“INR“). It further captures the recent changes made in the Foreign Trade Policy, 2015-22 (“FTP“) and the Handbook of Procedures, 2015-22 (“HBP“) to allow export benefits in respect of such exports settled in INR.

1. THIS article seeks to briefly capture the new mechanism put in place by the Reserve Bank of India (“RBI“) which allows Indian import and export transactions to be settled in Indian Rupees (“INR“). It further captures the recent changes made in the Foreign Trade Policy, 2015-22 (“FTP“) and the Handbook of Procedures, 2015-22 (“HBP“) to allow export benefits in respect of such exports settled in INR.